♦️ How to find your brand’s unique positioning in crowded markets

|

We've talked about the 3C's that drive a brand's positioning in our Profit-Led Branding Framework: Company, Competition, and Customer. And in today's edition of How Brands Win, we'll look into the second C: Competition. If you missed the article on Company Analysis, you can read it here. Now let's see how a rental company with seven cars became a global giant, how to find gaps in crowded markets, and how to discover your brand’s unique positioning:

|

|

Enterprise was profitable.

But Taylor wanted to grow.

The question he had was how.

Should they open in the airports and find a way to differentiate themselves?

Or should they stick to city centers?

To decide on Enterprise’s next steps, Taylor did market research himself.

He visited cities and airports around, checking out the competition.

And what he found out surprised him.

First, airports were full of car rental and leasing companies.

Some said they provided the best cars.

Some said only they had unlimited mileage.

And some others claimed they provided the best customer service by “trying harder” than the market leader.

But they were all lined up one next to each other in the airports.

So the competition was fierce.

On the other hand, the picture was different in the city centers.

The problem he noticed at his dealership existed in every city.

Customers had no option to have a car whenever they needed a short-term rental.

They either had to go to the airports.

Or stay without a car.

So Taylor made his decision on how to expand.

They were going to skip airports altogether and open offices only in towns and city centers.

They were going to differentiate Enterprise on convenience.

|

When you pay attention, the market shows you the way

We’ll talk about the results of Enterprise’s strategy.

But first, let’s think together.

Thanks to his observation while working in the car dealership, Taylor identified an unmet customer need.

And he realized nobody in the market —even beyond his city— provided that value.

So there was a gap that Enterprise could fill.

But not every executive is as lucky as Jack C. Taylor.

Usually, unmet customer needs are not that obvious.

It requires some digging to uncover them.

And that’s why one of the three C’s that drive positioning in our framework is Competition.

There are three main steps to analyze the competition.

I’ll use the Enterprise example to explain them:

1. List the alternatives

First, list all the alternatives to your brand.

If customers don’t buy from you, what other solutions can they use as an alternative?

The question is straightforward, but take these things into account:

- Always list the customer’s status quo (not making a purchase and sticking to an existing solution) as an alternative. We’ve talked about how this increases customer inertia. As an example: if you are selling a B2B solution, the internal teams of your target customers can also be your competitors.

- Consider alternatives from other market categories. Your business might be competing with them from the customer’s point of view. Remember how McDonald’s milkshakes not only competed with Burger King’s milkshakes but also with bananas and Snickers.

- If there are too many alternatives within an indirect competitor category, try to group them. One example. Let’s say you are a sales training provider. LinkedIn is your indirect competitor as it also offers sales courses. But you don’t have to consider LinkedIn, Coursera, and Udemy separately. Only list the category as an alternative (e.g. online education platforms).

So in Enterprise’s case, the main alternatives from the customers’ perspective looked like this:

- Hertz

- Avis

- Budget

- Public transportation (indirect)

- Taxi (indirect)

2. Find what everybody is competing on

Now you have the list of alternatives.

The next step is finding the key competitive factors that everybody competes on.

We’ve talked about them in detail for value innovation.

Some questions that can help you identify competitive factors:

- What value do alternatives claim to deliver? Who are they trying to target?

- What are their perceived strengths and weaknesses of alternatives from customers’ perspective?

- What are the main reasons non-customers don’t buy any of the alternatives?

In Enterprise’s case, the main competitive factors were:

- Price

- Cars

- Rental mileage

- Customer service

- Convenience

3. Find the unmet customer needs

You listed the alternatives and the competitive factors.

Now think about how alternatives would score on each factor relative to others.

Then put all alternatives on a map based on the most important competitive factors.

This will visually show the gaps in the market.

Three points to keep in mind here:

- In all markets, some competitive factors become “expected” by customers over time. So alternatives will have similar scores for those. A common example in today’s world is good customer service. You can’t differentiate your brand by providing decent customer service anymore — because it’s expected from everybody. If you want to differentiate on an “expected” competitive factor, you have to do something exceptional — like Ritz-Carlton’s $2,000 budget per employee per customer to delight customers.

- The competitive factor you’ll choose to differentiate on has to be aligned with your company’s strengths. We’ve talked about that in Company Analysis. So play to your strengths and ignore your weaknesses.

- If you can’t find a gap based on the competitive factors you listed, create a new competitive factor to change the game. One example. All pizza restaurants used to compete on taste, ingredients, the way of cooking, etc. But Domino’s ignored all these factors and created a “delivery speed” factor to win.

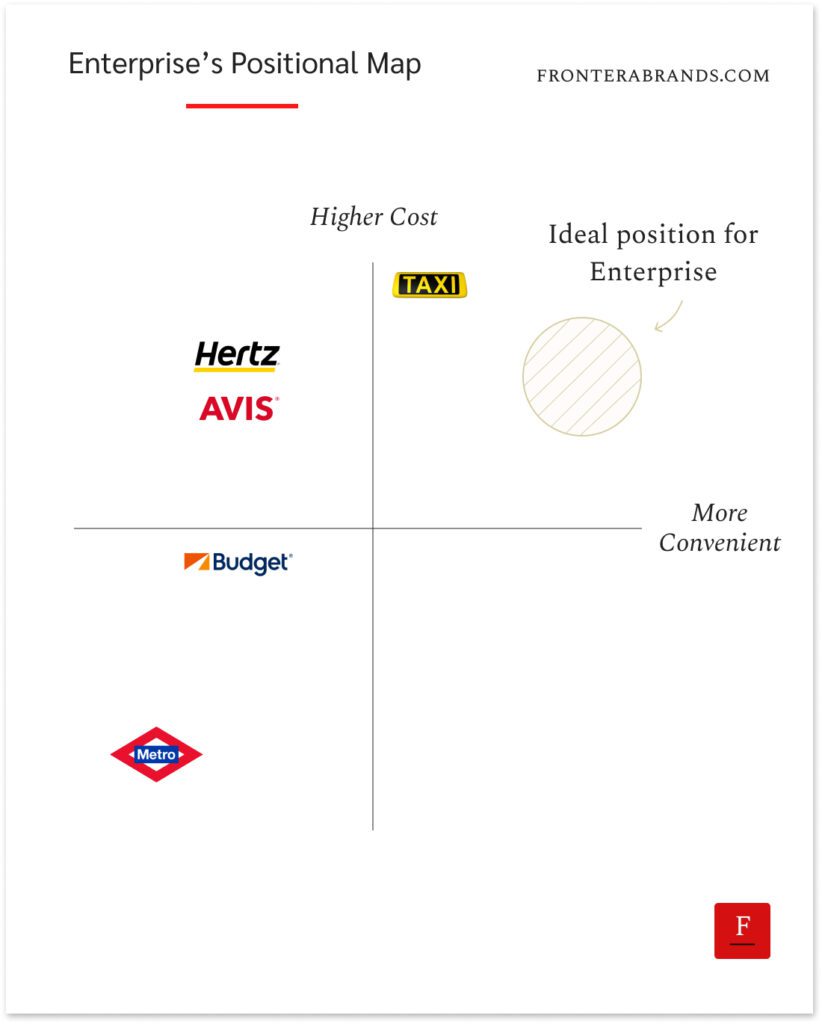

So let’s put Enterprise’s alternatives on a positional map based on two key factors —cost and convenience— and how they score for each.

|

The map immediately shows the gap in the market.

Hence it makes Enterprise’s ideal positioning obvious.

Enterprise didn’t have any cost advantage against its direct competitors Hertz or Avis.

And Budget had already claimed the low-cost position.

So competing on cost would be difficult.

But Enterprise could clearly win on convenience.

And the other alternatives?

No car rental company can beat public transportation on cost.

But rental cars are much more convenient — so Enterprise could beat public transportation there.

Taxis?

For regular use, they cost much more than a rental car.

Plus, a rental car is also more convenient than taxis especially if the pickup office is close to where customers live.

That means Enterprise could also win against taxis.

And guess what?

Enterprise’s positioning worked.

Competitors ignored Enterprise at first, thinking it would never succeed.

But Enterprise kept growing only by opening offices in city centers.

They even added pickup services to make things even more convenient for customers.

When others realized the ingenuity of the strategy, it was too late.

Enterprise was already making a 9-figure yearly revenue.

So thanks to creating a different value (and sticking with it for a long time), Enterprise turned from a seven-fleet car rental office into a global giant.

Yes, today you can find Enterprise car rentals in airports.

But they expanded into airports only after 38 years in 1995 when they were already a multi-billion dollar company.

–

The moral of the story?

Every brand has to offer something different to the world.

Customers don’t need more of the same.

But to find your way to differentiate, first you have to know what you are differentiating against.

You have to know the alternatives.

You have to know what factors the market competes on.

Only then can you find your unique positioning.

Only then can you find your way to be different.

What are your business goals for 2025?

“More customers.”

“Higher revenue.”

“Better conversions.”

All of them are fine goals for the new year.

But the real problem is not setting them.

The real problem is how to turn them into reality.

Well, here’s the truth.

It will be hard to hit those numbers unless your prospects see your brand’s value—instantly.

That’s where most brands fail.

Their message is either vague or too similar to their competitors.

So prospects don’t get it.

And they don’t buy.

Think about it.

A clear message that immediately shows your real value on your website, sales decks, and ads.

A clear message that makes prospects say “This is exactly what I need.”

Would that increase your chances of achieving your 2025 goals?

Remember.

Your competitors are also setting goals.

But only brands that stand out with a powerful message will win.

And we help B2B brands nail down their positioning and create a clear message that cuts through the noise.

Want to achieve your goals in 2025?

Fill out this form, let’s chat.

You can reply to this email with your thoughts and feedback. I'd be happy to hear from you — I read and reply to all messages.

And you can connect with me here on LinkedIn.

Have a great day.

Ozan

Founder - Frontera

Frontera

Join 10,000+ B2B founders getting the strategies of iconic brands.

Every business has dozens of problems at any given time. Even thriving ones. A new regulation comes up and you have to comply. You have to hire but can’t find the right candidate. Or your clients churn and you have to find out why. Being in business means dealing with problems. It’s the same for your potential clients. The problem your firm claims to solve is among a huge list of problems your buyers have. They have limited time and resources. But many problems to solve. So how do they decide...

The biggest mistake in B2B messaging is copying consumer brands. I know. Who doesn’t want to be inspirational like Nike? Who doesn’t want to influence buyers with a strong mission like Patagonia’s? But think about it. These are consumer brands. They sell commoditized products. A jacket is a jacket. No matter what brand you buy from, the product functionally does the same thing. So to differentiate themselves, consumer brands have to give intangible meaning to their tangible products. They...

In 1970, Listerine’s marketing department was feeling the heat. P&G had launched a new mouthwash brand as a competitor a few years before. They called it Scope. And they attacked Listerine’s obvious weakness — taste. Listerine burned like medicine. Consumers knew it. So Scope entered the market using taste as its differentiator. They claimed a mouthwash didn’t have to taste bad. And they were quickly gaining market share with aggressive ad campaigns. “Scope fights bad breath without giving...